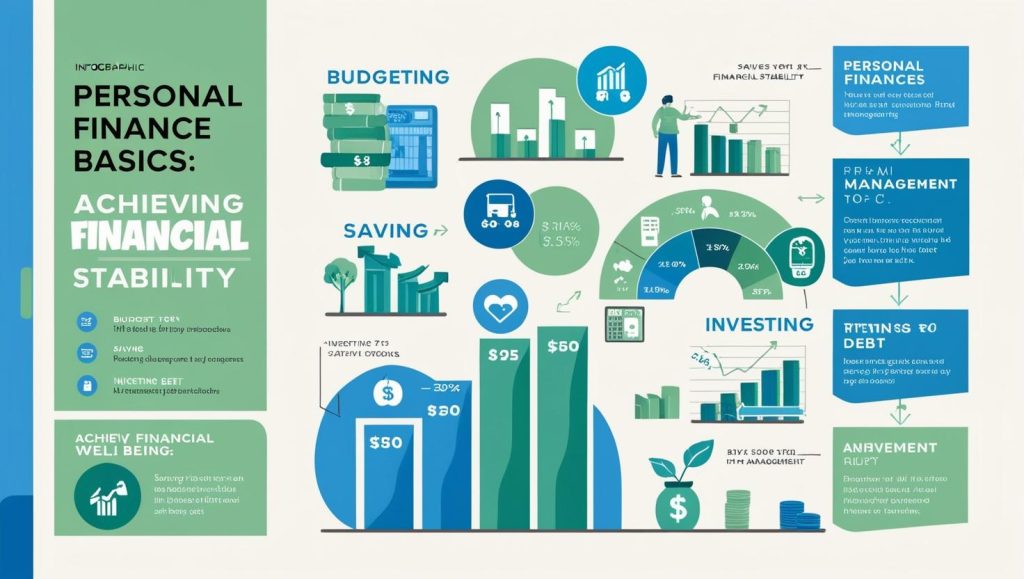

Personal Finance Basics: Achieving Financial Stability

Understanding Personal Finance Basics

Embarking on the journey to financial stability begins with mastering personal finance basics. By understanding the core principles of income management, spending control, savings discipline, and investment strategies, you can lay a robust foundation for your financial future. This guide will inspire you to take confident steps toward achieving your financial goals.

Banking services play a significant role in managing one’s finances efficiently. By utilizing savings accounts, checking accounts, and various financial products, you can optimize your financial management.

Personal finance is the art of managing your money to achieve financial stability and security. It encompasses budgeting, saving, and investing, along with making informed decisions about spending. By adopting sound personal finance practices, you can build a solid foundation for financial well-being.

Assets are crucial elements in the broader landscape of personal finance. They represent anything of value or resource you have that can be converted into cash. Understanding the different types of assets, such as real estate, stocks, bonds, and personal possessions, is essential for building wealth and ensuring financial security. By managing and growing your assets wisely, you can enhance your financial portfolio and fortify your financial future.

Understanding your income is fundamental in creating a solid financial plan. Analyzing your income sources and levels allows you to accurately budget and allocate resources effectively. By recognizing your primary streams of income, whether it’s from employment, investments, or other sources, you can ensure that your expenses are aligned with your earnings, ultimately supporting your journey towards financial wellness.

Resource allocation is a fundamental aspect of personal finance that involves strategically distributing your income across various financial needs and goals. By prioritizing essential expenses, savings, and investments, you can ensure a balanced approach to managing your finances. Effective resource allocation enables you to maximize the utility of your income, avoid unnecessary debt, and work toward achieving your financial objectives systematically.

Incorporating personal finance education early in life can have a significant impact on one’s ability to manage finances effectively. Understanding fundamental concepts such as budgeting, saving, investing, and debt management can empower individuals to make informed financial decisions. Personal finance literacy not only helps in navigating immediate financial challenges but also paves the way for long-term economic wellbeing. By prioritizing personal finance education, you can build a foundation that supports a lifetime of financial security and success.

Additionally, modern digital banking platforms offer tools and features that facilitate budgeting and expense tracking, further simplifying your journey toward financial stability.

Expenses are a critical aspect of personal finance that require careful monitoring and management. A clear understanding of your recurring and variable expenses allows you to effectively allocate your income and avoid overspending. By categorizing your expenses and analyzing your spending patterns, you can identify opportunities to cut costs and redirect funds toward savings and investments, bringing you closer to financial security.

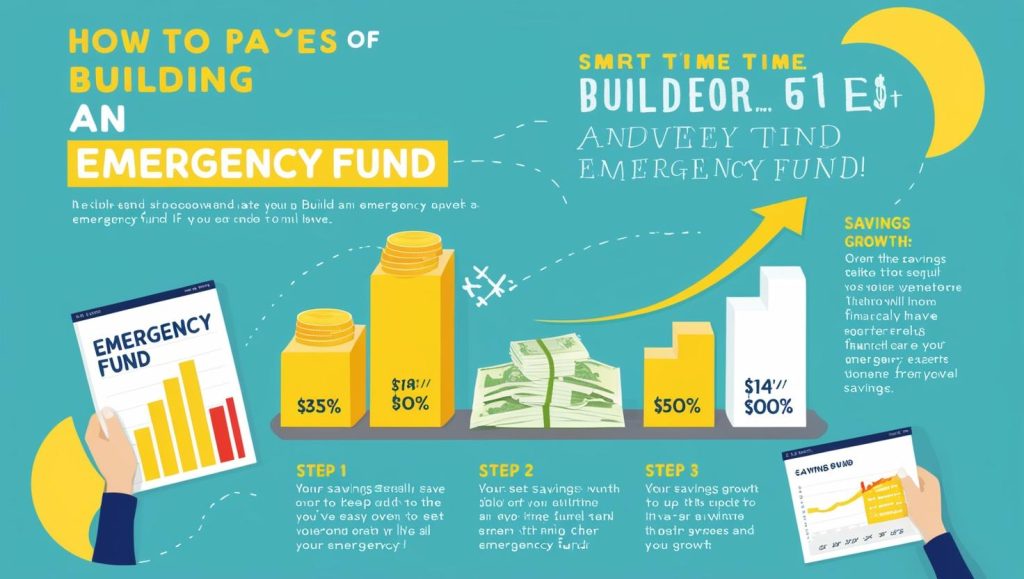

An emergency fund is a vital component of any solid financial plan. It serves as a financial safety net, providing you with a cushion to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss. By setting aside a portion of your income regularly, you can gradually build an emergency fund that offers peace of mind and financial stability, helping you avoid resorting to high-interest loans or credit cards during times of crisis.

Insurance is another critical aspect of safeguarding your financial stability. It provides protection against unforeseen circumstances that could potentially derail your financial plans. Whether it’s health, home, or auto insurance, having the right coverage ensures that you are well-equipped to handle unexpected events without jeopardizing your financial goals. Regularly reviewing and adjusting your insurance policies can help you stay adequately protected as your life circumstances change.

Monitoring your spending is an important aspect of financial management. By keeping an eye on your day-to-day expenditures, you can identify areas where you might be overspending and make adjustments to stay within your budget. Doing so not only aids in conserving funds for savings, but it also ensures that you meet your financial obligations and prevents the accumulation of unnecessary debt.

Loans are an integral part of many people’s financial journeys. Whether for education, purchasing a home, or starting a business, loans can provide the necessary capital to achieve significant life goals. However, it is crucial to understand the terms and conditions of any loan agreement, as well as how it fits into your overall financial strategy. Proper management of loans can help you avoid unnecessary debt and ensure that they serve as a beneficial tool in reaching your financial objectives.

Setting Financial Goals

Setting clear, achievable financial goals is the cornerstone of financial success. Begin by identifying short-term objectives, such as building an emergency fund, and long-term aspirations, like planning for retirement. By defining these goals, you create a roadmap that guides your financial decisions and motivates you to stay on track.

Practicing financial discipline is key to achieving these goals. It involves consistently sticking to your budget, resisting the temptation of unnecessary purchases, and making deliberate decisions about saving and investing. Financial discipline ensures that you not only meet your immediate financial needs but also stay focused on long-term financial health.

Budgeting for Success

Creating a Budget Plan

A well-structured budget is essential for financial stability. Utilize the 50/30/20 rule as a basic framework: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This approach ensures that you cover essential expenses while still enjoying life and preparing for the future.

Understanding personal finance basics is the foundation of managing your money effectively. It involves getting a grasp of fundamental concepts such as budgeting, saving, investing, and considering insurance needs. By familiarizing yourself with these core elements, you set the stage for a healthier financial future. Personal finance basics guide you in making informed choices that align with your long-term goals, allowing for responsible management of both current and future financial challenges.

Tracking Expenses

Tracking your expenses is crucial for maintaining control over your finances. By diligently monitoring where your money goes, you can identify areas for improvement and make informed spending decisions. This practice empowers you to adjust your budget as needed and avoid lifestyle inflation.

Understanding personal finance is fundamental to achieving your long-term financial goals. Personal finance encompasses budgeting, savings, and investment strategies tailored specifically to your unique financial situation. By taking control of your personal finance, you can balance earning, spending, saving, and investing in a way that aligns with your future aspirations and current lifestyle.

Saving Strategies

Building an Emergency Fund

An emergency fund is your financial safety net, providing peace of mind in times of uncertainty. Aim to save 3-6 months’ worth of expenses in an accessible savings account. Start with small, regular deposits and automate contributions to steadily build your fund over time.

Financial discipline is essential for building a strong financial foundation. It requires adhering to a budget, avoiding impulsive purchases, and consistently prioritizing savings. Employing financial discipline can help ensure that you are able to maintain your emergency fund, contribute to long-term savings, and manage debt effectively. By instilling financial discipline in your daily financial decisions, you create a sustainable financial lifestyle that can withstand unexpected shocks and provide stability across your financial journey.

Financial literacy plays a critical role in achieving personal financial stability. It involves understanding a variety of financial concepts such as budgeting, investing, and saving which can empower individuals to make informed decisions.

Understanding personal finance is integral to financial stability. It encompasses managing your money effectively, including budgeting, saving, and investing. By honing your personal finance skills, you can make more strategic financial decisions, optimize your financial resources, and achieve your financial goals, whether they be short-term or long-term.

By improving your financial literacy, you can effectively manage your finances, set realistic financial goals, and develop strategies to achieve them, which is especially important when planning for emergencies or long-term savings.

Creating a budget is an essential step towards financial stability and effective money management. A well-planned budget helps you track your income and expenses, ensuring that you live within your means and set aside funds for savings and emergencies. By allocating your resources thoughtfully, you can prioritize important financial goals and reduce unnecessary spending, paving the way for a more secure financial future.

Mindful spending is another crucial aspect of maintaining financial stability. By tracking your expenditures and identifying areas where you can cut back, you can allocate more resources toward savings and emergency funds. This not only strengthens your financial position but also reduces stress and enhances overall well-being by ensuring money is being spent in a way that aligns with your financial goals.

Long-term Savings Options

Long-term savings are vital for wealth accumulation and future security. Explore options such as retirement accounts (401(k), IRA) and high-yield savings accounts. By consistently contributing to these accounts, you can harness the power of compounding interest to grow your wealth.

In this age of financial complexity, understanding personal finance basics is essential for everyone aiming for economic stability. With the right knowledge and tools, you can transform your financial future. Developing sound habits around budgeting, saving, and spending can create lasting peace of mind and security.

Embracing the principles of personal finance empowers you to make informed decisions that align with your goals and aspirations. By mastering budgeting techniques and spending wisely, your finances can reflect your personal values and priorities. This strategic approach will significantly enhance your financial resilience and adaptability in any economic climate.

A dedicated focus on building an emergency fund is crucial for shielding yourself from life’s uncertainties. This safety net not only offers financial protection but also provides the confidence to pursue new opportunities without undue stress. Establishing a fund ensures that unforeseen events do not derail your financial journey.

Furthermore, the integration of investment strategies can transform your savings into substantial wealth over time. By exploring diverse portfolios and including assets tailored to your risk tolerance, you can secure your financial future. This proactive approach to investing fosters growth and stability, even amid market volatility.

Ultimately, achieving financial stability is an evolving process that requires commitment, education, and courage. By cultivating a mindset oriented towards financial discipline and growth, you set the stage for a sustainable and prosperous future.

Managing Debt

Mastering personal finance basics is an empowering endeavor that paves the path to economic independence and security, influencing both your present and future financial successes. By embracing essential strategies and principles, you create a structured framework for managing your finances effectively.

Understanding income sources and expenditure management is foundational to this journey. A keen insight into your financial inflows and outflows establishes a robust baseline for informed decision-making. This clarity supports effective planning, encouraging you to live in alignment with your financial capabilities and aspirations.

The discipline of consistent saving becomes an ally in safeguarding against life’s uncertainties. Cultivating a habit of setting aside funds regularly, enables you to grow your financial reserves steadily. These reserves act as a buffer, insulating you from unexpected expenses and providing peace of mind.

Decisive spending control and budgeting efforts not only bolster your financial resilience but also empower you to fund future objectives. Practicing mindful spending and adhering to budget guidelines strengthens your economic framework. The strategic allocation of resources reflects personal values while meeting essential needs.

Personal finance literacy is a vital asset, enhancing your ability to navigate the complex financial landscape with confidence. This constantly evolving skill set equips you with the foresight needed for sound investment decisions, ensuring that your financial portfolio grows and sustains your wealth.

Ultimately, building a sustainable financial lifestyle requires dedication and ongoing refinement. Cultivating knowledge, discipline, and strategic foresight prepares you to face any financial challenge, paving a prosperous journey to financial stability and beyond.

Prioritizing Debt Payments

Effective debt management is key to financial health. Prioritize your debt payments using strategies like the avalanche method (paying off the highest interest debt first) or the snowball method (tackling the smallest balance first). These approaches help you reduce debt efficiently and improve your credit score.

Diving into personal finance basics equips you with essential knowledge for cultivating a secure economic future. By focusing on income management, spending control, and investment strategies, you fortify your financial stability.

Establishing a clear roadmap through financial goal-setting empowers you to make diligent decisions and stay inspired. This disciplined approach not only anchors your current well-being but ensures a prosperous and resilient future.

Automating savings and prioritizing an emergency fund are vital first steps towards safeguarding your financial health. They lay the groundwork for consistent growth while reducing risk during life’s unpredictabilities.

Embracing a strategic investment perspective accelerates wealth accumulation over time. Diversifying portfolios aligned with your risk tolerance ensures sustainable financial growth even amid market fluctuations.

A commitment to continuous learning and adaptation transforms personal finance mastery into a lifetime pursuit. Through steadfast dedication, you build a prosperous path, achieving lasting economic independence and confidence.

Understanding Interest Rates

Understanding interest rates is crucial for managing debt wisely. Differentiate between good debt (like mortgages) and bad debt (such as high-interest credit cards). By comprehending how interest rates impact your payments, you can make informed decisions about debt repayment and consolidation.

Personal finance plays a vital role in achieving overall financial stability and independence. It involves making informed decisions about managing earnings, expenses, saving for future goals, and investments. By understanding personal finance, you can create a realistic budget, set attainable financial goals, and develop strategies for wealth accumulation and protection. Regularly revisiting and adjusting your personal finance strategies in response to life changes can lead to greater financial success.

Personal finance plays a vital role in achieving overall financial well-being. It’s essential to develop a comprehensive approach to manage and grow your finances effectively. By budgeting, saving, and making informed financial decisions, you can not only meet your immediate needs but also work towards long-term goals such as buying a home or planning for retirement. Understanding the fundamentals of personal finance empowers you to take control of your financial journey, reduce stress, and build a secure future.

Investing for the Future

Achieving financial stability is a rewarding journey, guided by the basics of personal finance. Whether it involves understanding income sources or managing expenditures, personal finance forms the cornerstone for achieving your economic goals.

It’s about aligning your spending with your priorities and future aspirations. Cultivating a habit of disciplined savings and investing is integral to this process, ensuring you’re well-prepared for life’s uncertainties. This involves not only building an emergency fund but also engaging in long-term wealth accumulation strategies.

Equipped with financial literacy and strategic foresight, you can navigate the complexities of the financial world with confidence. Investing effectively is not just about potential profits but managing risk to sustain financial growth amidst economic fluctuations.

Ultimately, mastery of personal finance basics is an empowering endeavor that lays the groundwork for a secure and prosperous future. Embrace this responsibility with optimism and take confident strides toward economic independence.

Types of Investments

Investing is a powerful tool for building wealth over time. Familiarize yourself with various investment vehicles, including stocks, bonds, mutual funds, and ETFs. Each type offers unique benefits and risks, so diversify your portfolio to mitigate risk and maximize returns.

Personal finance basics are your roadmap to success.

Harnessing the power of sound financial practices can change your life. With a focus on income management and prudent spending, you create a framework that supports all your financial ambitions. Cultivating healthy habits in personal finance means consistently setting aside money, ensuring you’re financially prepared for unexpected events and future goals.

Every step toward financial stability begins with understanding essential concepts. These principles guide effective decision-making. Your journey to financial empowerment involves more than just managing finances; it’s about creating a lifestyle that encompasses both planning and enjoyment.

By embracing the art of budgeting, you secure your present and fortify your future. The balance between immediate needs and long-term aspirations becomes clear, driving your path towards consistent economic growth.

Ultimately, comprehending personal finance basics is both a skill and a gift. It provides the tools required to navigate life’s complexities confidently, granting you the peace of mind that comes with knowing your financial future is in capable hands.

Risk Management

Managing risk is an integral part of investing. Assess your risk tolerance and maintain a long-term perspective to navigate market fluctuations. Regularly review your portfolio to ensure it aligns with your financial goals and risk appetite.

Planning for retirement should begin as early as possible to ensure a comfortable and secure future. Consider utilizing retirement accounts like 401(k)s or IRAs, which offer tax advantages and opportunities for growth over time. Regularly contribute to these accounts and review their performance to align them with your long-term financial objectives. Understanding the power of compound interest and time in building your retirement nest egg is crucial for effective retirement planning. Making consistent contributions and benefiting from employer match programs can significantly enhance your savings over the years.

Insurance plays a vital role in personal finance by providing a safety net against unforeseen events that could potentially derail your financial plans. Whether it’s health, life, property, or auto insurance, having adequate coverage ensures that you are protected from significant financial losses. Evaluating your insurance needs regularly and ensuring your policies are up to date can offer peace of mind and secure your financial future.

Maintaining a good credit score is essential for accessing financial products and securing advantageous interest rates. Your credit score can impact your ability to obtain loans, credit cards, and even influence rental agreements or job applications. Therefore, it’s important to regularly check your score, understand the factors that affect it, and take steps to improve it when necessary. Timely bill payments, reducing existing debt, and being strategic about new credit applications can positively influence your credit score.

Protecting Your Financial Health

Safeguarding your financial future involves comprehensive insurance coverage. Evaluate your needs for health, auto, home, life, and disability insurance. By comparing policies and optimizing costs, you can secure the protection you need without overextending your budget.

Planning for Retirement

Retirement planning is a critical component of personal finance basics. Start saving early to take advantage of compound growth. Develop a strategy that includes regular contributions to retirement accounts and investments that align with your long-term goals. By planning ahead, you can ensure a comfortable and fulfilling retirement.

A credit card can be a useful tool in managing your finances, provided it is used responsibly. It offers convenience and can serve as a short-term source of credit. However, it’s important to pay off balances in full each month to avoid high-interest charges. Additionally, using a credit card can help build your credit score, which is crucial for securing loans or better interest rates in the future. When choosing a credit card, consider factors such as rewards programs, interest rates, and fees to select one that best suits your financial habits.

Understanding taxes is an important aspect of managing your finances. They can significantly affect how much money you have available for savings, investments, and day-to-day expenses. Knowing the different types of taxes you’re liable for, such as income, property, and capital gains taxes, can help you plan effectively. Consider utilizing tax-advantaged accounts, like IRAs or 401(k)s, which can aid in reducing taxable income and growing your retirement savings more efficiently.

Remember, personal finance is a journey that requires continuous learning and adaptation. By mastering these basics, you empower yourself to make informed decisions and achieve lasting financial stability. Stay committed to your goals, and let your financial journey inspire others.